As the tax season approaches, it's essential to have a solid plan in place to minimize your tax liability and maximize your savings. Edelman Financial Engines, a renowned financial planning firm, has developed a comprehensive tax planning checklist to help individuals and families navigate the complex world of taxes. In this article, we'll break down the key elements of this checklist and provide you with actionable tips to optimize your tax strategy.

Understanding Your Tax Obligations

Before diving into the checklist, it's crucial to understand your tax obligations. This includes familiarizing yourself with the different types of taxes, such as income tax, capital gains tax, and estate tax. Edelman Financial Engines recommends reviewing your tax returns from previous years to identify areas where you can improve your tax planning.

Tax Planning Checklist:

1.

Income Tax Planning: Review your income sources, including wages, investments, and self-employment income. Consider strategies like tax-loss harvesting, charitable donations, and retirement contributions to reduce your taxable income.

2.

Capital Gains Tax Planning: If you have investments, such as stocks or real estate, consider the tax implications of buying and selling these assets. Edelman Financial Engines suggests using tax-deferred accounts, like 401(k) or IRA, to minimize capital gains tax.

3.

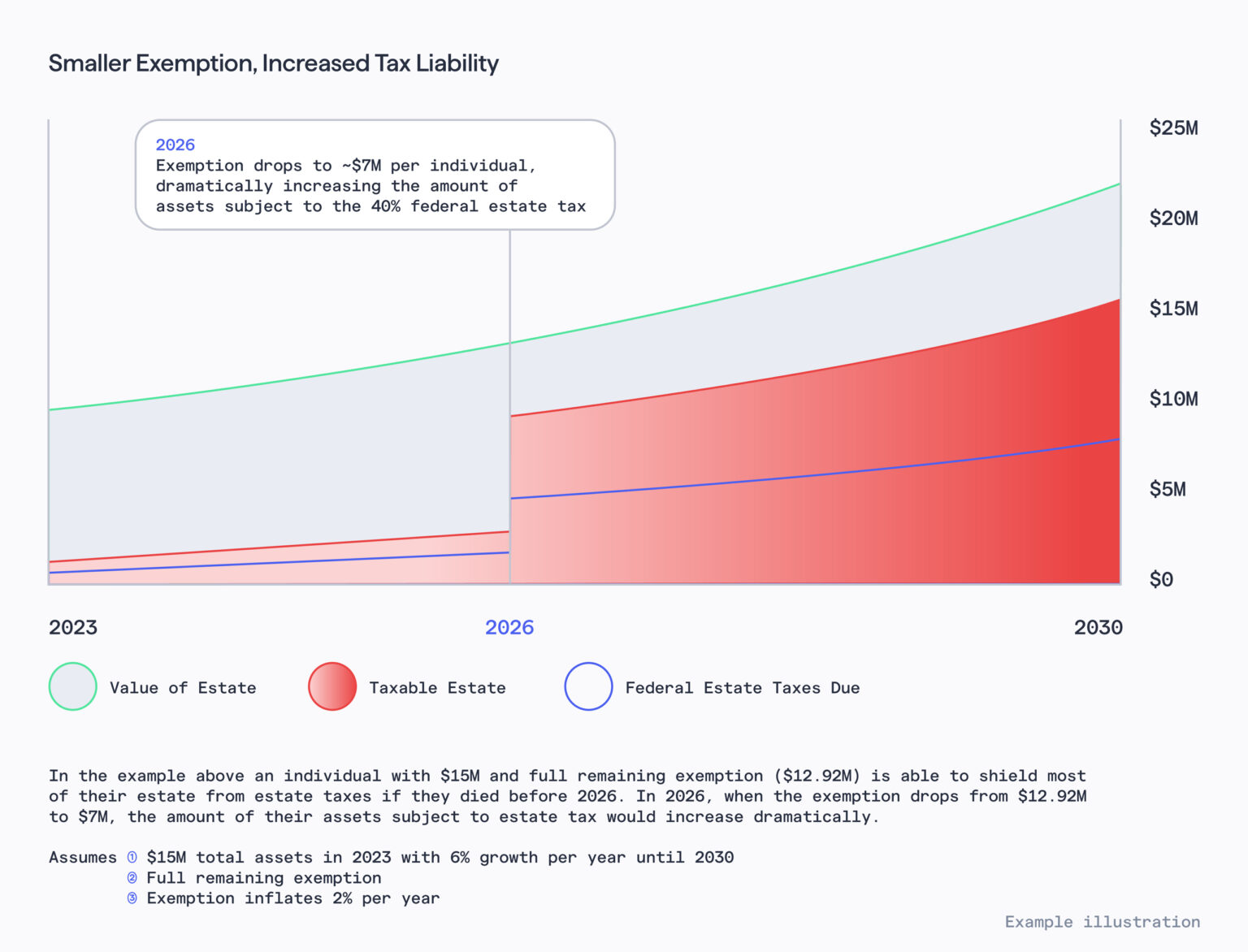

Estate Tax Planning: If you have a large estate, it's essential to plan for estate taxes. This includes creating a will, establishing trusts, and making strategic gifts to minimize tax liability.

4.

Retirement Planning: Review your retirement accounts, such as 401(k) or IRA, and consider contributing to a Roth IRA or traditional IRA to reduce your taxable income.

5.

Education Planning: If you have children or grandchildren, consider using tax-advantaged education accounts, such as 529 plans, to save for education expenses.

Additional Tips for Effective Tax Planning

In addition to the checklist, Edelman Financial Engines recommends the following tips to optimize your tax strategy:

Stay informed about tax law changes: Tax laws and regulations are constantly evolving. Stay up-to-date with the latest changes to ensure you're taking advantage of available tax savings opportunities.

Consult a tax professional: If you're unsure about any aspect of tax planning, consider consulting a tax professional or financial advisor.

Review and adjust your plan regularly: Tax planning is not a one-time event. Regularly review your plan and make adjustments as needed to ensure you're on track to meet your financial goals.

Tax planning is a critical component of overall financial planning. By following the comprehensive tax planning checklist developed by Edelman Financial Engines, you can minimize your tax liability and maximize your savings. Remember to stay informed about tax law changes, consult a tax professional if needed, and regularly review and adjust your plan to ensure you're on track to meet your financial goals. With a solid tax plan in place, you can achieve greater financial security and peace of mind.

For more information on tax planning and financial management, visit Edelman Financial Engines today.